schedule h tax form 2020

The way to submit the IRS 990 - Schedule H on-line. If you received aany Wisconsin Works W2 payments or b county relief of 400 or more for any month of 2020 complete the TaxesRent Reduction Schedule below.

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

A Go to wwwirsgovScheduleH for instructions and the latest information.

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

. See page 5 of the Schedule H. The Waiver Request must be completed and submitted back to the Department. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Attach to Form 990. Round to the nearest whole dollar. Fill out all required lines in the selected file making use of our powerful PDF editor.

Complete Schedule H 100W Part II and enter the total of Part II line 4 column g on Form 100W Side 2 line 11a. Include the date of completing IRS 990. SCHEDULE H Form 990 Department of the Treasury Internal Revenue Service Hospitals Complete if the organization answered Yes on Form 990 Part IV question 20.

Instructions apply to the current ST-1-X and for all prior periods. Of Schedule H Section A for credit based on rent paid or Line 10 of Schedule H Section B for credit based on property tax paid. See pages 17 to 19 of the Schedule H instructions.

Make sure about the correctness of added info. Ad Register and Subscribe Now to work on your IRS Form 1040 Schedule H more fillable forms. Write the dividend payers name and label dividends received from certain foreign construction projects as FCP in Part II column a.

Amended Sales and Use Tax and E911 Surcharge Return Instructions updated 07082022 to include information for Schedule GT-X Amended Sales and Use Tax Holiday and Grocery Tax Suspension Schedule. Name of the organization. Open to Public.

If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our Taxpayer Assistance Division at 1 800 732-8866 or 1 217 782-3336. Ad Download Or Email Form B6H More Fillable Forms Register and Subscribe Now. Schedule h certification of permanent and total disability TAXPAYERS WHO ARE DISABLED DURING 2020 REGARDLESS OF AGE If you were certifi ed by a physician as being permanently and totally disabled during the taxable year 2020 OR you were the surviving spouse of an individual who had been.

If you qualify for homestead credit you may be able to use Schedule H-EZ to file your claim. Switch the Wizard Tool on to finish the process much easier. Download or Email IRS 1040 H More Fillable Forms Register and Subscribe Now.

1 00 - only if divorce or separation agreement on or before 123118 only if divorce or separation agreement on or before 123118 If less than zero enter zero. Select the button Get Form to open it and start modifying. SCHEDULE H Form 1040 Department of the Treasury Internal Revenue Service 99 Household Employment Taxes For Social Security Medicare Withheld Income and Federal Unemployment FUTA Taxes a Attach to Form 1040 1040-SR 1040-NR 1040-SS or 1041.

Inspection Go to wwwirsgovForm990 for instructions and the latest information. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. For Part II column d if any portion of a dividend also qualifies for the.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

2021 Schedule 1 Form And Instructions Form 1040

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Eitc Audit Document Checklist Form 886 H Eic Toolkit Checklist Toolkit Coaching Program

What Is A Schedule C Tax Form H R Block

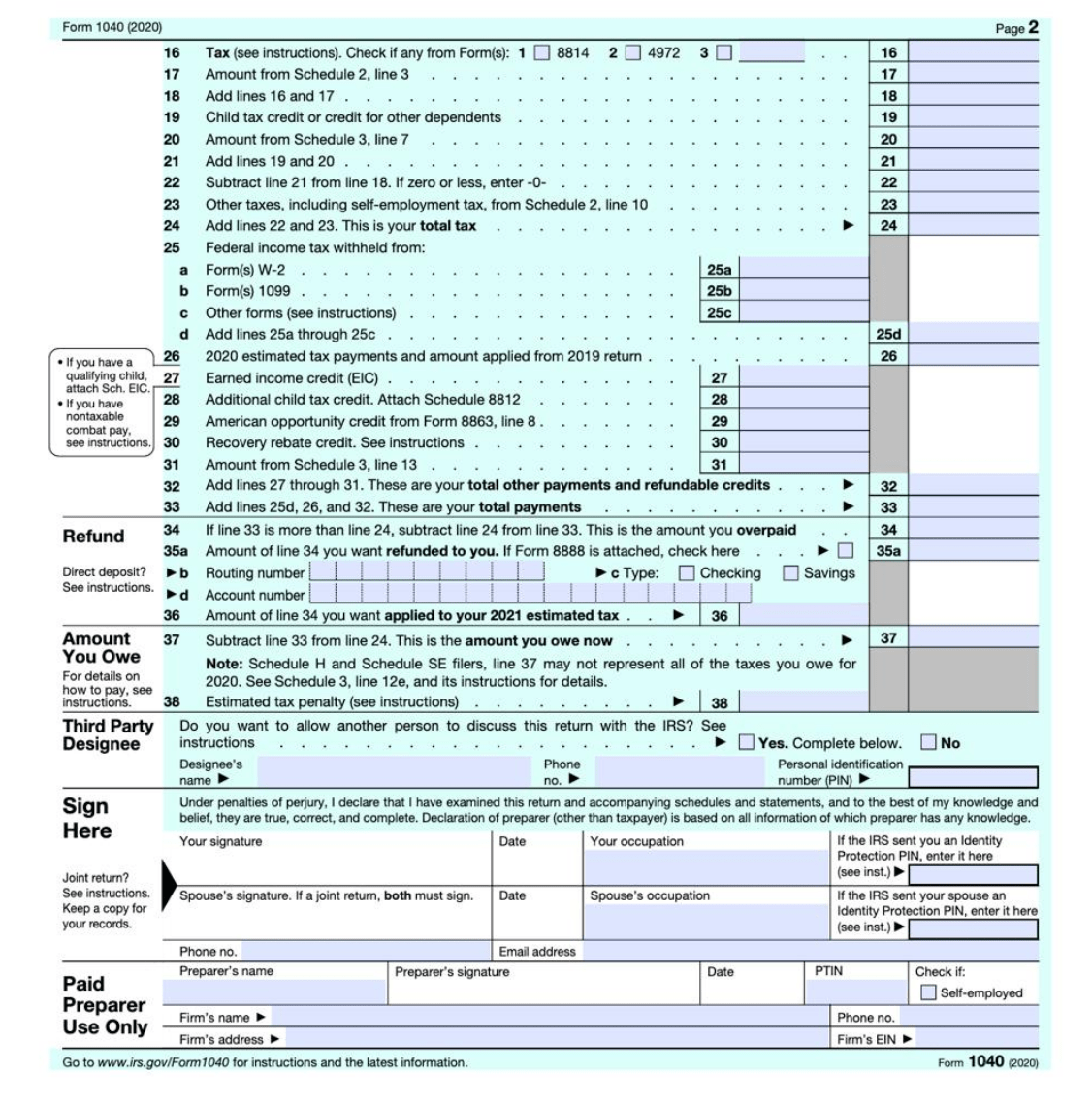

Irs Releases Form 1040 For 2020 Tax Year

Irs Releases Form 1040 For 2020 Tax Year

Bank Account 2020 Send Money Tax Forms Accounting

Irs Releases Form 1040 For 2020 Spoiler Alert Still Not A Postcard

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)